尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

In March, Phillip Swagel, director of the US Congress’s independent fiscal watchdog, told the Financial Times that America risked a Liz Truss-style market shock with its soaring debt pile. His reference to the former British prime minister’s “mini” Budget in September 2022 — which led to a sudden surge in UK government bond yields and ructions across financial markets — was an attempt to fend off complacency, rather than a warning of imminent implosion.

今年3月,美国国会独立财政监督机构负责人菲利普•斯瓦格尔(Phillip Swagel)向英国《金融时报》表示,美国不断飙升的债务规模可能会引发利兹•特拉斯(Liz truss)式的市场冲击。他提到这位英国前首相在2022年9月提出的“迷你”预算——该预算导致英国政府债券收益率突然飙升,并在金融市场引发动荡——是为了避免自满情绪,而不是警告即将崩盘。

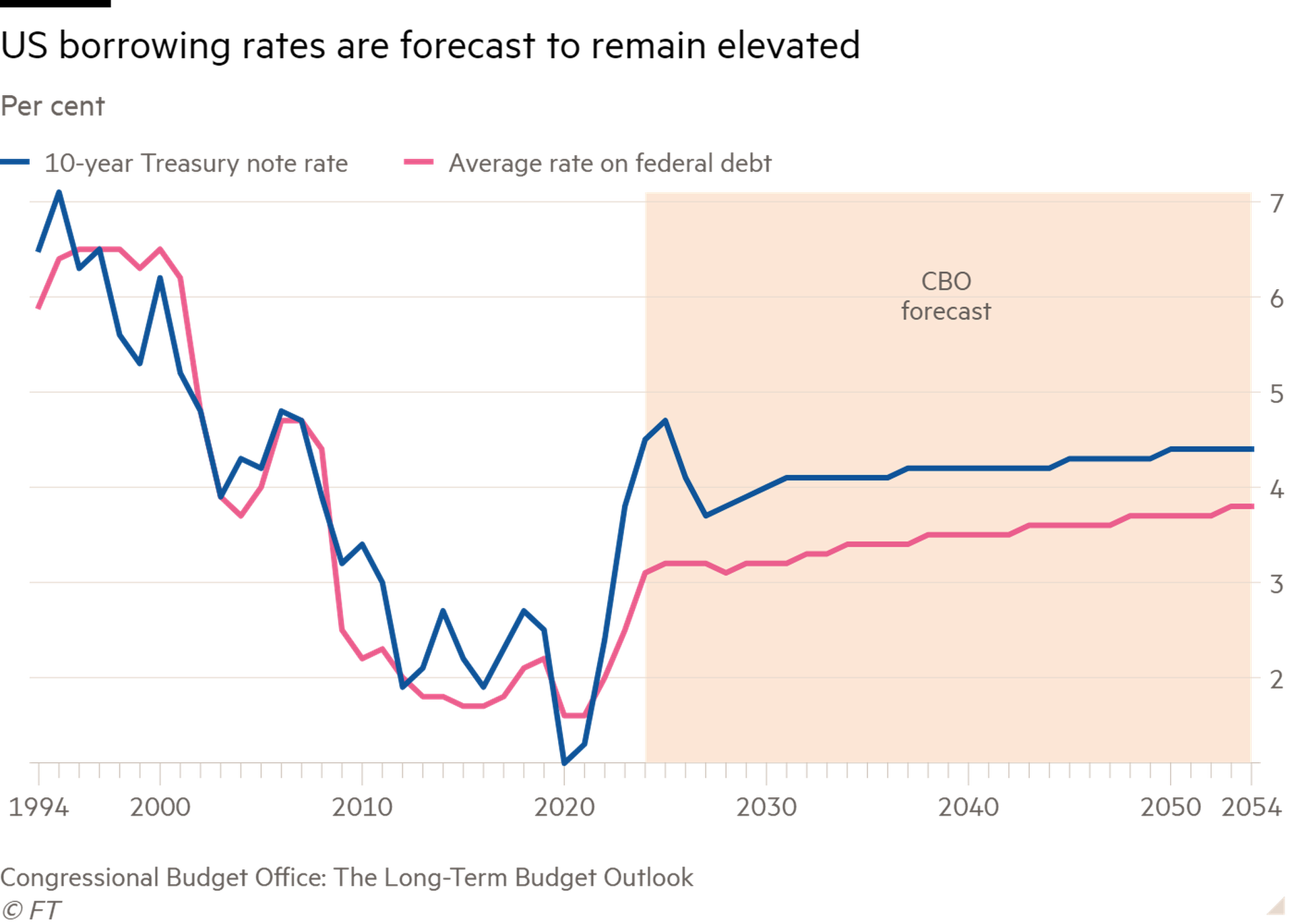

Swagel is right to sound the alarm. America’s debt is on an unsustainable path. The Congressional Budget Office projects America’s debt-to-GDP ratio will surpass its second world war high of 106 per cent by the end of the decade, and keep rising. The total deficit is forecast to average 5.5 per cent of GDP until 2030 — about 2 percentage points higher than the post-1940 mean. Net interest payments, which are currently around 3 per cent of GDP, are expected to keep creeping upward too.

斯瓦格敲响警钟是正确的。美国的债务正在走上一条不可持续的道路。美国国会预算办公室预计,到本十年末,美国的债务与国内生产总值之比将超过二战时106%的高点,并将持续上升。预计到2030年,赤字总额将平均占国内生产总值的5.5%,比1940年后的平均值高出约2个百分点。目前约占国内生产总值3%的净利息支出,预计也将继续缓慢上升。

Politics is an aggravating factor. Both the Democrats and Republicans heed the importance of fiscal responsibility in theory, but neither is prepared to tighten belts, particularly in an election year. Joe Biden proposed a $7.3tn budget plan for 2025. His presidential rival, Donald Trump, has vowed to renew tax cuts enacted during his time in the White House, which could add another $5tn to the nation’s debt, according to the Committee for a Responsible Federal Budget, a think-tank.

政治是一个加剧因素。民主党和共和党在理论上都重视财政责任的重要性,但都不准备勒紧腰带,尤其是在选举年。乔•拜登为2025年提出了73亿美元的预算计划。他的总统大选竞争对手唐纳德•特朗普(Donald Trump)誓言要延续自己在白宫期间实施的减税政策,根据智库负责任联邦预算委员会(Committee for a Responsible Federal Budget)的数据,这可能会使美国的债务再增加5万亿美元。

America’s growing debt puts upward pressure on its longer-term borrowing costs. Lax fiscal policy can raise inflation expectations and the perceived risk of holding debt for long periods. The hefty pipeline of debt issuance will also need to be absorbed by more price-sensitive investors, with the Fed now engaging in quantitative tightening.

美国不断增长的债务给其长期借贷成本造成了上行压力。宽松的财政政策会提高通胀预期和长期持有债务的感知风险。由于美联储目前正在实施量化紧缩,大量即将发行的债券也需要由对价格更加敏感的投资者来消化。

Elevated yields raise the cost of borrowing and could undermine economic growth. There is an increased vulnerability to rapid and disruptive movements in US bond markets. This has knock-on effects for credit and financial stability abroad too, since US Treasuries act as a benchmark for pricing debt globally. IMF research suggests that a 1 percentage point spike in US rates led to a 90 basis point rise in other advanced economies’ bond yields, and an increase in emerging markets of 1 percentage point. Restraints on domestic and global growth will only heighten the debt reduction challenge.

收益率上升会提高借贷成本,并可能破坏经济增长。美国债券市场更容易受到快速和破坏性波动的影响。由于美国国债是全球债务定价的基准,这也会对国外的信贷和金融稳定产生连锁效应。国际货币基金组织的研究表明,美国债券收益率每飙升1个百分点,就会导致其他发达经济体债券收益率上升90个基点,新兴市场债券收益率上升1个百分点。国内和全球增长受到的限制只会加剧削减债务的挑战。

America’s economic heft gives it substantial leeway. The dollar’s role as the international reserve currency means demand for US debt is ever-present, and AI-driven productivity growth could indeed help lessen its debt problems. But the country’s global influence may foster a dangerous complacency among its politicians. Ignoring the difficult tax and spending decisions needed to put debt on a more sustainable footing keeps the economy on a risky path amid political and economic uncertainty.

美国的经济实力给了它很大的回旋余地。美元作为国际储备货币的角色意味着,对美国债务的需求始终存在,而人工智能推动的生产率增长确实可能有助于缓解美国的债务问题。但该国的全球影响力可能会在其政客中滋生一种危险的自满情绪。面对政治和经济不确定性,忽视将债务置于更可持续基础上所需的艰难的税收和支出决策,会让经济走上一条危险的道路。

For instance, another Trump presidency would come with significant unknowns. Reports that his team is drawing up proposals to water down the Fed’s independence are deeply worrying for inflation control. A well-behaved bond market hinges on clarity and confidence in government policy — as Truss could attest. Rising geopolitical instability and risks in financial markets, from private capital to liquidity problems in Treasury markets, are also exposures. Shocks could damp growth and drive harmful spikes in yields, making debt dynamics even worse.

例如,特朗普再次担任总统将带来巨大的未知数。有报道称,他的团队正在起草削弱美联储独立性的提案,这让人对通胀控制深感担忧。一个表现良好的债券市场取决于政府政策的明确性和信心——特拉斯可以证明这一点。地缘政治不稳定的加剧和金融市场的风险,从私人资本到美国国债市场的流动性问题,也都是风险。冲击可能会抑制经济增长并导致收益率出现有害的飙升,使债务动态更加恶化。

Sooner or later policymakers need to engage in bipartisan efforts to think seriously about how America funds itself responsibly. If not, panicked bond traders may force them to. As the IMF chief economist, Pierre-Olivier Gourinchas, said last month: “Something will have to give.”

迟早政策制定者需要进行跨党派努力,认真思考美国如何负责地为自己筹资。否则,陷入恐慌的债券交易员可能会迫使他们这样做。正如国际货币基金组织首席经济学家Pierre-Olivier Gourinchas上个月所说:“有些东西必须要放弃。”